EXAMPLE section

AN EXAMPLE OF THE TYPE OF RESULT OUR SCREENS ARE DESIGNED TO PRODUCE - even over a shorter time frame than the recommended "15 years, or longer":

The following screen clip is from www.nasdaq.com > Quotes > DIS > Dividend History and provides more detailed information, regarding the dates relevant to the dividend history of a stock, than the manual instructions below produce using Yahoo.com, which only reflects the Effective Ex-Dividend Date (i.e., the date after which purchase of the stock will not result in ownership as of the Record Date, which permits the owner to receive the currently Declared Dividend).

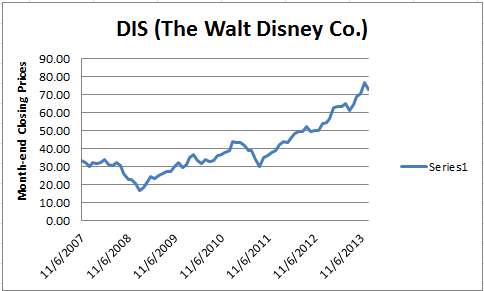

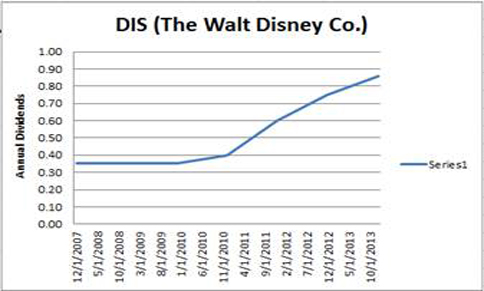

If you had purchased DIS at its highest closing price between 11/23/2007 and 1/18/2008, which was $33.24 on 12/24/2007, and, as indicated above, not been eligible for the 12/5/2007 dividend, your first dividend would have been the $0.35 per share "Ex/Eff Date" 12/11/2008, announced and payable at the depth on the 2008 market crash (good companies survive market crashes). Think of this investment as the equivalent of having "deposited" $33.24 into a Christmas Savings Account in 2007, and your yield after the 1st year, on 12/11/2008, would have been 1.05%. And letting your "deposit" stay in place for the six years would have produced the following additional yields for the 2nd thru 6th years: 2nd yr: 1.05%; 3rd yr: 1.20%; 4th yr: 1.80%; 5th yr:2.25%; 6th yr: 2.58% (and the stock price at 12/12/2013 closed at $69.63, reflecting a 109% increase in value).

BUY AND HOLD works for this site's "investment approach": invest in companies that have a history of increasing their dividend, and that also every 10 or 15 years have had a "stock split".

Also, the chart of Annual Dividends is much easier to "relate to" for "actionable" information:

Hence, the "mantra" inserted throughout this site: INVESTING so STOCK PRICE MOVEMENT is IRRELEVANT when deciding when to SELL.

For your first attempt at using the following manual instructions for "How to ID what to invest in", input DIS (the stock symbol for The Walt Disney Company) to see if that company still qualifies as "a DIVIDEND GROWTH COMPANY in which you can invest", as it did when the preceding paragraph and image above it were created.

How to ID what to invest in -- and a couple of important "tips" if you do invest in stocks!

INVESTING so STOCK PRICE MOVEMENT is IRRELEVANT when deciding when to SELL.

1. With your internet browser open Yahoo.com and click on Finance (or use this link: http://finance.yahoo.com/ ).

2. In the "Search Finance" input area either type in the company's stock Symbol or its name.

3. When the company you are researching appears in the drop down search results list, click on it.

a. LOOK FOR COMPANIES WITH POSITIVE EARNINGS: If the "EPS (ttm)" is a positive amount continue to the next step, 3. b., -- OTHERWISE, STOP AND START OVER INVESTIGATING ANOTHER COMPANY.

b. LOOK FOR COMPANIES WITH DIVIDENDS: If the "Div & Yield" shows an annual "Div"idend amount, and next to it in parenthesis a "Yield"% continue to the next step, 3. c., -- OTHERWISE, STOP AND START OVER INVESTIGATING ANOTHER COMPANY.

c. MAKE CERTAIN THE "% Dividend Payout" IS REASONABLE: Now calculate the "dividend payout" as a % by dividing the "Div" amount by the "EPS (ttm)" amount (i.e., Div/EPS (ttm)), then convert this ratio to a % by moving the decimal point two place to the right. If the "% dividend payout" is less than 75.0% (i.e., a smaller ratio than .7500, for example .2800, which converts to 28.0%) then continue to the next step -- OTHERWISE, STOP AND START OVER INVESTIGATING ANOTHER COMPANY.

4. CHECK THE COMPANY'S RECENT DIVIDEND HISTORY: In the list of links down the left side find "Historical Prices" and click on it.

5. Change the "Set Date Range" "Start Date" to a year at least eight years earlier than the current year.

6. Then move the "bullet" point to the right of the dates from "Daily" to "Dividends Only" by clicking on "Dividends Only".

7. Then click on "Get Prices".

8. LOOK FOR UPWARD TRENDS IN DIVIDEND PAYOUT: You should see that the three most recent full calendar years reflect at least one dividend payment in each of those years.

9. If the test in the previous step is met then continue to the next step -- OTHERWISE, STOP AND START OVER INVESTIGATING ANOTHER COMPANY.

10. THE DIVIDEND HISTORY SHOULD BE EVALUATED IN TERMS OF THE TOTAL DIVIDEND(S) PAID EACH YEAR: At a minimum there should have been at least one dividend increase in one of the past 3 years -- and no decreases in that first 3 year period, unless it was related to a stock split. [Note1: Sometimes companies will pay a large one-time special dividend, then revert back to the normal dividend payment pattern. Don't count such an occurrence as a "dividend decrease".] [Note2: If you see there have been splits (AND SPLITS WHERE THE FIRST NUMBER IS BIGGER THAN THE SECOND NUMBER ARE A GOOD THING!!) then x:y means that at the indicated date the record of shares held by an existing stockholder was adjusted to show x for each y share(s) previously held (and proportionately on that date there was an equivalent adjustment to the share price and the dividend, so effectively there was no immediate change in the value of what the shareholder owned).]

11. If the test in the previous step is met then continue to the next step -- OTHERWISE, STOP AND START OVER INVESTIGATING ANOTHER COMPANY.

12. MAKE CERTAIN THAT THE "Dividend Growth Rate" IS SUFFICIENT TO JUSTIFY THE COMPANY BEING CALLED A Dividend Growth Company: SKIP THIS STEP UNLESS the dividend history shows dividends were paid for at least the last 6 years. If dividends were paid for the last 6 years then the TOTAL DIVIDENDS PAID FOR the most recent FULL- year should be at least 1.4 times the TOTAL DIVIDENDS PAID FOR the FULL-fifth year back.

13. If the test in the previous step is met, OR QUALIFIES TO BE SKIPPED, then continue to the next step -- OTHERWISE, STOP AND START OVER INVESTIGATING ANOTHER COMPANY.

~~AT THIS POINT YOU HAVE THE EQUIVALENT OF OUR PRIMARY SCREEN RESULTS, a listing of stocks that are okay to “Hold”, because they haven’t met any of our “to be sold” criteria. (Note: Our Primary Screen criteria also exclude all: Over-the-Counter, ADR/ADS, REIT, Limited Partnership, as well as Non-optionable stocks and stocks with fewer than three analysts following them.)

ADDITIONALLY, STOCKS THAT MEET THE FOLLOWING STEPS 14. AND 15. ARE THE EQUIVALENT OF OUR SECONDARY SCREEN “BUY” LIST.

14. In the list of links down the left side find "Balance Sheet" and click on it.

15. MAKE CERTAIN THAT THE COMPANY'S "Balance Sheet" and "Income Statement" ARE GROWING STRONGER: Make certain in the window that appears under the title "Balance Sheet" that the "View" shows "Annual Data" as black(or selected); then scroll all the way to the bottom of the columns with numbers and make certain, reading from right to left (i.e. the oldest dated column to the most current dated column), that the "Net Tangible Assets" amount has been "improving" (at a minimum the left, most recent amount, should be greater than the right, oldest amount) -- "improving" means that if the amounts are negative (i.e. bracketed) then the negative amounts have got smaller, or have turned positive.

~~Next – In the list of links down the left side find "Income Statement” and click on it.

MAKE CERTAIN THAT THE COMPANY'S "Income Statement" IS GROWING STRONGER: Make certain in the window that appears under the title "Income Statement" that the "View" shows "Annual Data" as black(or selected); then scroll all the way to the bottom of the columns with numbers and make certain, reading from right to left (i.e. the oldest dated column to the most current dated column), that the "Net Income Applicable To Common Shares" amount has been "improving" – and none of the three amounts should be negative (i.e. bracketed).

16. If the test in the previous step is met then continue to the next step -- OTHERWISE, STOP AND START OVER INVESTIGATING ANOTHER COMPANY.

17. Congratulations!! INVESTING so STOCK PRICE MOVEMENT is IRRELEVANT when deciding when to SELL. You have found a DIVIDEND GROWTH COMPANY in which you can invest. Next it is important to understand When to Sell a Dividend Growth Company Stock: THIS IS HOW YOU SHOULD MANAGE DIVIDEND GROWTH STOCKS IN YOUR PORTFOLIO, if you do invest in them, MOST IMPORTANTLY you should ONLY SELL WHEN you’ve purchased our current Primary Screen and you find that a Dividend Growth stock you own isn’t still on our current Primary Screen list (not being on our Primary Screen list means a stock may have met at least one of our first 5 criteria for when to be sold), or using yahoo.com you can manually obtain the data to apply the following criteria for deciding when to sell a Dividend Growth stock:

A. a dividend is reduced (EXCEPT IF CAUSED BY, AND PROPORTIONATE TO, A STOCK SPLIT);

B. or the % dividend payout exceeds 95% of EPS (Earning Per Share);

C. or the % dividend payout is between 75% - 95% of EPS for two consecutive years;

D. or there has been no dividend increase for 3 years (EXCEPT A STOCK SPLIT CAN BE COUNTED AS EQUIVALENT TO A DIVIDEND INCREASE);

E. or consider selling at least half of a company's stock (and the remainder next year, if this condition persists) if, assuming dividends have been paid for the last 6 years, the annual per share DIVIDEND PAID FOR the most recent FULL- year isn't at least 1.4 times the annual per share DIVIDEND PAID FOR the FULL-fifth year back (in making this calculation be careful to properly adjust the divisor, "annual per share DIVIDEND PAID FOR the FULL-fifth year back", for any stock splits during the five+ year time frame).

F. or consider selling if a "STOCK BUY-BACK" is announced AND THERE IS NO DIVIDEND INCREASE ANNOUNCED;

G. and consider selling if there is an unexpected departure of the company's CFO (Chief Financial Officer).

[Note3: These criteria for selling have no relationship to the current price of a stock, and no relationship to the purchase price of a stock, because what we are recommending is a buy-and-hold strategy for dividend-growth stocks!! ALSO, THESE "SELL RULES" SHOULD BE SUSPENDED (for probably 12 to 18 months) WHEN ANY VERY UNUSUAL MARKET DROP OCCURS ("crashes" such as in 1987, or the "once in 100 years" events in 1929 or 2008, or the "flash-crash" of May 6, 2010), because after every such event in the history of the market new highs have occurred.]

18. IMPORTANT TIP #1: Because approximately one out of every twenty investable companies will "screw up" so badly that their common stockholders will lose everything, make certain you invest in a diversified portfolio of at least twenty companies so you only lose one-twentieth (5%) of your originally invested funds when that happens! Consider the following as a more detailed guide of how to accomplish this:

19. GIVEN THE FOLLOWING TEN"SECTORS" OF THE ECONOMY (each of which having multiple "Industry" sub-categories, which sub-categories should be ignored for simplicity) : Basic Materials/Commodities; Industrial Goods; Transportation; Consumer Discretionary/Cyclical; Consumer Staples/Non-Cyclical; Energy; Financial; Healthcare; Technology; Utilities and Telephone. After first excluding Over-The-Counter Exchange companies and ADR/ADS companies, USE "EQUAL WEIGHT INVESTING" FOR EACH of these ten SECTORS, by identifying AN EQUAL NUMBER OF COMPANIES FOR EACH SECTOR (BUT AT LEAST TWO COMPANIES FOR EACH SECTOR) that meet our criteria/screen as "a company in which you can invest". THEN INVEST APPROXIMATELY EQUAL AMOUNTS IN EACH OF THE COMPANIES (i.e. if you have $10,000 to invest in 20 companies then that means you should invest $500 in each, and divide the equal amount you are going to invest in each company by the price per share of each company, and buy that many shares). Also, be sure to find out if your broker has a method (usually at no extra cost) for you to designate that your dividends be automatically re-invested in fractional shares of the stock paying the dividend, if so make that designation. [Note4: The website https://www.motifinvesting.com/ enables you to easily make an equally weighted single dollar amount investment in a "motif" portfolio of as many as 30 stocks for a single transaction fee of $9.95. (Please note: At this writing motifinvesting.com didn't facilitate automatic re-investment of dividends, and there are certain citizenship requirements to open an account.)]

20. IMPORTANT TIP #2: Almost never, never, NEVER, "rebalance"! Only rebalance if the value of your holdings in a company exceed 30% of the total value of your portfolio, THEN "REBALANCE" BY ONCE EVERY 12 MONTHS SELLING 20% OF THAT POSITION UNTIL IT IS LESS THAN 15% OF YOUR TOTAL PORTFOLIO, THEN STOP ALL "REBALANCING" UNTIL A POSITION AGAIN EXCEEDS 30% OF THE TOTAL PORTFOLIO!!

Back to Top